Deviation Charges: How Forecast Errors Steal Your Solar Revenue

For solar asset owners and managers, the sight of a clear sky is a promise of revenue. But in India's tightly controlled grid, that promise is constantly under threat from one critical, non-operational expense: Deviation Charges, also known as Deviation Settlement Mechanism (DSM) charges.

These penalties, enforced by the Central Electricity Regulatory Commission (CERC) and State Electricity Regulatory Commissions (SERCs), are designed to keep the grid stable. For you, they are a direct attack on your project’s profitability and a significant factor in your overall Levelized Cost of Electricity (LCOE).

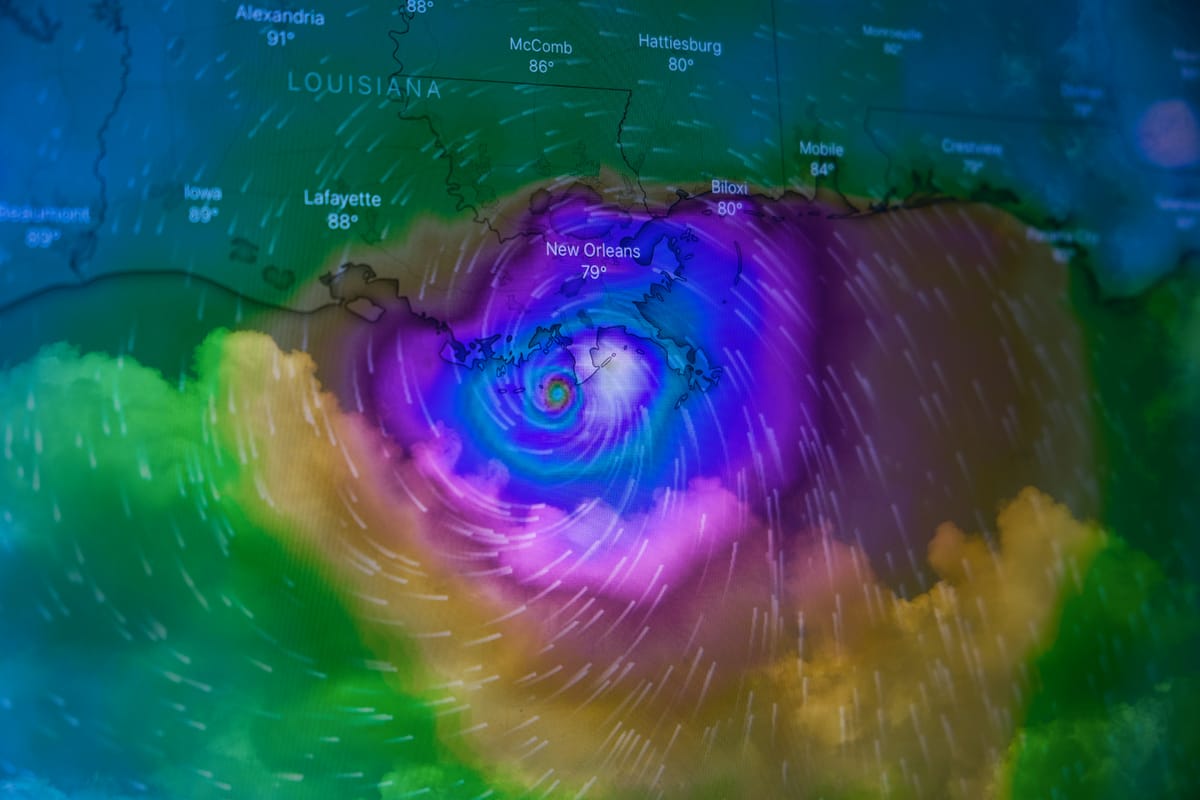

If your Day-Ahead forecast is off, those clouds (or unexpected clear skies) don't just reduce generation; they trigger a cash-flow bleed.

The Core Problem: Misaligned Commitments

Every grid-connected entity, especially intermittent generators like solar farms, must submit a detailed Day-Ahead schedule to the respective Load Despatch Centre (RLDC/SLDC). This schedule is your commitment—it's what the grid operator plans to balance the entire system around.

A Deviation Charge is levied when your actual power injection deviates from this committed schedule by a margin outside the regulatory Tolerance Band (which is frequently being tightened by regulators like CERC).

The penalty structure creates two distinct, costly financial hits:

1. The Under-Generation Penalty (The Costliest Mistake)

This happens when your Actual Injection is less than your Scheduled Generation.

- The Scenario: You bid to supply 100 MW in a 15-minute block, but sudden cloud cover means you only deliver 85 MW (a 15 MW shortfall).

- The Grid Impact: The grid operator must scramble to procure expensive replacement power at short notice to maintain system frequency.

- The Financial Hit: You are penalized by being charged a high rate, often linked to the highest marginal cost in the Real-Time Market (RTM) or ancillary services. This penalty is designed to be punitive to discourage grid instability, resulting in a direct and significant revenue loss.

2. The Over-Generation Penalty (Selling Low, Paying Later)

This happens when your Actual Injection is more than your Scheduled Generation.

- The Scenario: You bid 100 MW, but a sudden clearance of haze leads to 110 MW of production (a 10 MW surplus).

- The Grid Impact: The grid is forced to absorb unexpected surplus power, potentially pushing grid frequency too high.

- The Financial Hit: The surplus energy you inject is often bought by the system operator at low or sometimes zero/negative balancing prices. In some cases, CERC regulations state that you may not receive payment for over-injection when the grid frequency is high (e.g., above 50.05 Hz). You effectively lose the value of the energy produced.

The Regulator's Tightening Grip: Why This Matters Now

Regulatory bodies in India are continuously tightening the rules to ensure grid discipline as the share of variable Renewable Energy (RE) grows.

- Reduced Tolerance Bands: The trend is to decrease the permissible deviation (e.g., proposals to reduce the solar tolerance band from 10% to 5%). A smaller band means that minor forecast errors that were previously acceptable now incur penalties.

- Focus on Available Capacity: New regulations and amendments (like the CERC DSM Regulations, 2024) are introducing sophisticated ways to calculate deviation, increasing the liability on Wind and Solar (WS) sellers.

- High-Priority Payments: DSM charges are designated as high-priority payments. Failing to pay on time can result in substantial late payment surcharges (0.04% per day) or even the requirement to open a Letter of Credit (110% of average weekly liability) in favour of the RLDC.

The result is clear: poor forecasting is now a major financial liability, not just an inconvenience. Studies show that poor forecasting can lead to revenue losses of several per kWh, severely impacting the viability of fixed-tariff PPAs.

The Solution: AI-Driven Precision Forecasting

The key to mitigating these charges is not luck, but actionable intelligence. You need to shift from generic forecasting to high-precision, AI-driven models that understand your specific asset and the hyper-local Indian weather.

- Hyper-Local Data Fusion: Combining high-resolution Numerical Weather Prediction (NWP) models with satellite imagery that tracks cloud movement over your farm in real-time.

- Probabilistic Bidding: Moving beyond a single point prediction to understand the range of possible outcomes. This allows asset managers to make risk-weighted bids—bidding slightly conservatively when risk is high to ensure you stay within the Tolerance Band.

- BESS Integration: For hybrid projects, high-accuracy forecasting is the brain of the battery. It instructs the Battery Energy Storage System (BESS) to inject power to cover predicted under-generation or absorb power to prevent over-generation, turning a penalty into a strategic hedge.

The Takeaway for Asset Owners

Reducing Deviation Charges is not an O&M task; it is a Financial Risk Management Strategy. By investing in market-leading forecasting services, you are not buying a weather report—you are buying revenue certainty.

Ready to stop losing money to clouds? It's time to evaluate your current forecast's accuracy and benchmark it against the precision required to succeed in India's evolving grid.